Should You Choose a 15, 20 or 30 Year Mortgage Term?

We’ve found that many of our customers looking for a Charlotte home loan are curious about their mortgage term options. The length of your mortgage can have a big impact on your monthly payments, and it affects how quickly you can pay off your house, not to mention the overall interest you’ll pay on the home loan.

Here’s a quick primer on mortgage term lengths and how they make a difference over time.

Most common mortgage lengths in Charlotte

The most common mortgages in the Charlotte area are 15- and 30-year fixed-rate mortgages, including FHA, VA, USDA and conventional loans. You can also get a 10-year or a 20-year fixed-rate mortgage.

Other options include adjustable rate mortgages (ARMs), where the interest rate resets periodically. These are available in 3-, 5-, 7- or 10-year terms, though they aren’t as popular as fixed-rate loans.

All these choices mean that your lender can help you tailor your mortgage to be just right for you and your financial situation.

How mortgage length works

In basic terms, fixed-rate mortgages consist of a loan amount, an interest rate, and a repayment term. You borrow a set amount of money at a certain rate of interest. Then you have a fixed amount of time to repay the loan.

Charlotte mortgage lenders like Fairway Mortgage of the Carolinas offer mortgages with a range of term lengths to suit borrowers’ needs. If you have a 15-year mortgage, that means you get 15 years to pay back what you borrowed. But if you have a 30-year mortgage, you get twice as long to pay it back. With fixed-rate mortgages, you pay the same amount each month for the length of the loan.

When you start the mortgage process, it’s definitely helpful to have an idea of how different term lengths will affect your loan.

Term Length Changes Everything

Take a look at an example, using our mortgage calculator. Say you borrow $300,000. Your interest rate is 5%. If you take out a 30-year mortgage, you’ll finish paying off the loan 30 years from now, in June 2052. You’ll borrow a total amount of $579,767.35, including interest. Your monthly payment (not including taxes, PMI or insurance) would be $1,610.46.

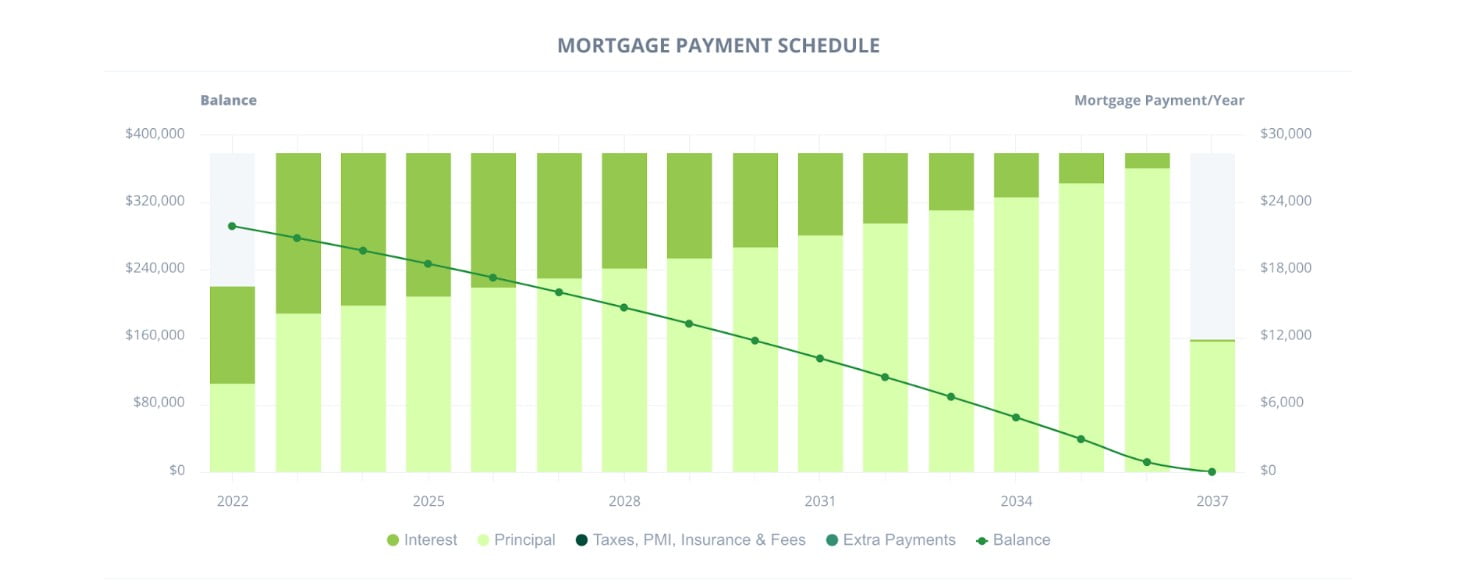

Now suppose you have the same loan, but with 15-year terms instead. You’ll finish paying off the loan in June 2037, meaning that’s when you’ll own your home free and clear. You’ll borrow a total amount of $427,028.56, including interest. Your monthly payment (not including taxes, PMI or insurance) would be $2,372.38.

With the 15-year loan, you’ll pay your home off much faster, and you’ll pay less in interest overall. But your monthly payment will be much higher. With the 30-year loan, you have much longer to pay off the loan, so the payments are smaller, but you’ll wind up paying more interest in the end.

The tradeoffs are lower payments, but more interest paid over time, or higher payments but less interest paid in the end.

Say you chose something in the middle, such as a 20-year mortgage. In that case, your monthly payment would be $1,979.87. Over 20 years, you would pay $175,168.13 in interest, for a total repayment of $475,168.13. That puts your monthly payment amount between that of the 15- and the 30-year mortgages, and it puts your total amount paid between them, too.

Or, say you want to speed things up with a 10-year mortgage. You’d have it paid off in 2032, with just $81,835.85 in interest paid over that time frame. But your monthly payment would be $3,181.97.

Take a look at the chart below to see how the term length affects the interest, total paid, and monthly payments.

Then, try out our mortgage calculator to see how your payments would change with a smaller or larger loan amount. And don’t forget to account for the down payment, PMI, closing costs, homeowners insurance, property taxes, and other costs that will affect your loan amount and monthly payments.

How to choose the best mortgage length

With so many options, it can be tough to choose the right mortgage terms. Here are some questions to consider:

How long do you plan to stay in the home? Consider whether this is your first home or your forever home.

How fast do you want to have your home paid off? 30 years can be a long time away.

How much is the home you want to purchase? A more expensive home may be tougher to pay off in 10 or 15 years.

Are you buying or refinancing? If you’ve already been paying on a mortgage, you may want to refinance to a shorter term.

How much can you afford to pay each month? A smaller monthly payment might be a priority for you.

How comfortable are you with the total amount paid? The tradeoff for smaller monthly payments is a longer term, which incurs more interest.

You don’t have to figure this out on your own. The mortgage planners at Fairway Mortgage of the Carolinas are ready to help you with expert advice, years of experience and access to great mortgage loans that fit your needs. You can even start your application online.

Contact us to get a free home loan pre-approval and find the perfect home loan for your situation.

Schedule a call with a Mortgage Planner today!

Copyright©2022 Fairway Independent Mortgage Corporation. NMLS#2289. 4750 S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800. All rights reserved. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Opportunity. *Loan-to-Value (LTVs) and Combined Loan-to-Value (CLTVs) may vary by program requirements.

References:

https://www.mortgagecalculator.org/

https://www.rocketmortgage.com/learn/average-mortgage-length

https://www.rocketmortgage.com/learn/15-year-fixed-mortgage

https://www.usbank.com/home-loans/mortgage/mortgage-rates/north-carolina.html

https://www.chase.com/personal/mortgage/education/financing-a-home/choosing-mortgage-term